SMSignals.com

Simple Asset Allocation Timing

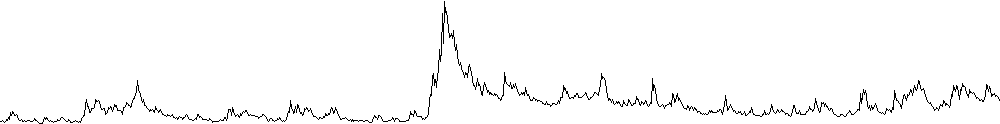

In A Quantitative Approach to Tactical Asset Allocation Mebane Faber presents a simple market timing system that compares the current price of a security to its 200-Day Simple Moving Average. When the price is above the 200-Day moving average, you buy the security, when it is below, you sell. The table below, shows the current prices versus the the 200-SMA.| Asset | Current Price1 | 200-Day SMA |

|---|---|---|

| S&P 500 | 3857.54 | 4373.53 |

| US Gov Bond | 102.103 | 109.471 |

| US Real Estate | 86.03 | 86.03 |

| Foreign Stocks | 49.1967 | 57.9118 |

| GS Commodities Index | 22.37 | 20.5983 |

Notes: